24/06/ · Using Ichimoku Kinko Hyo Indicator in MT4. It's very easy to find and launch the Ichimoku Kinko Hyo indicator in MT4. You don't need to download the Ichimoku indicator separately, as it comes bundled with the core tools of the platform. All you need to do is look at the list of Indicators within the 'Navigator' blogger.comted Reading Time: 9 mins 28/08/ · I also use a stochastic (8,3,3) to confirm my entries. Ichimoku does tend to produce many false signals when a pair is not trending, I find this the most difficult part of using this indicator. I'mm still working on perfecting my system. EffectiveFX Thanx for the reply 14/12/ · Ichimoku Trading Guide - How To Use The Ichimoku Indicator Best Forex Trading StrategyThose Ichimoku indicators are all-in-one indicators that provide inform Author: Forex indicators

How to Use Ichimoku Cloud in Forex? - Forex Education

In this article, we will talk about the functionality of Ichimoku Charts and how to use them in forex trading. Here we also learn how to read Ichimoku Charts. The chart seems visually complex, but signals should be accessible. Here you can learn Ichimoku charts, signs and the style of presenting records. Ichimoku Indicators or trading systems are not newly introduced to the market. It originated in Japan in the sixteenth century. This system combines multiple indicators to develop an overall scenario of the market.

It may also provide high probability trading signals to the traders. The Ichimoku tool is mainly used in the futures and commodities markets. But forex recently started using it in their medium.

The traders that manage a position for a long time are the primary users because this system works well over longer timeframes. Looking at wise charts is a little bit complex but should be easily understood, how to use the ichimoku forex indicator.

The Ichimoku charts Trading System is introduced as an oscillator due to the various trends below and overpricing candlesticks for a particular time interval.

The system also consists of the remarkable quality of enhancing as per the future. It may also be depicting prior market sentiments. Its nomenclature follows Japanese tradition.

But the Cloud consists of different features and three other line indicators that help signal effective trading setup and patterns. Traders can eliminate market noise through longer timeframes and raise the results of the Ichimoku Indicators technical support tool. Traders will get Ichimoku indicators in MetaTrader 4 trading software. Here we provided you with details about the main components of Ichimoku indicators.

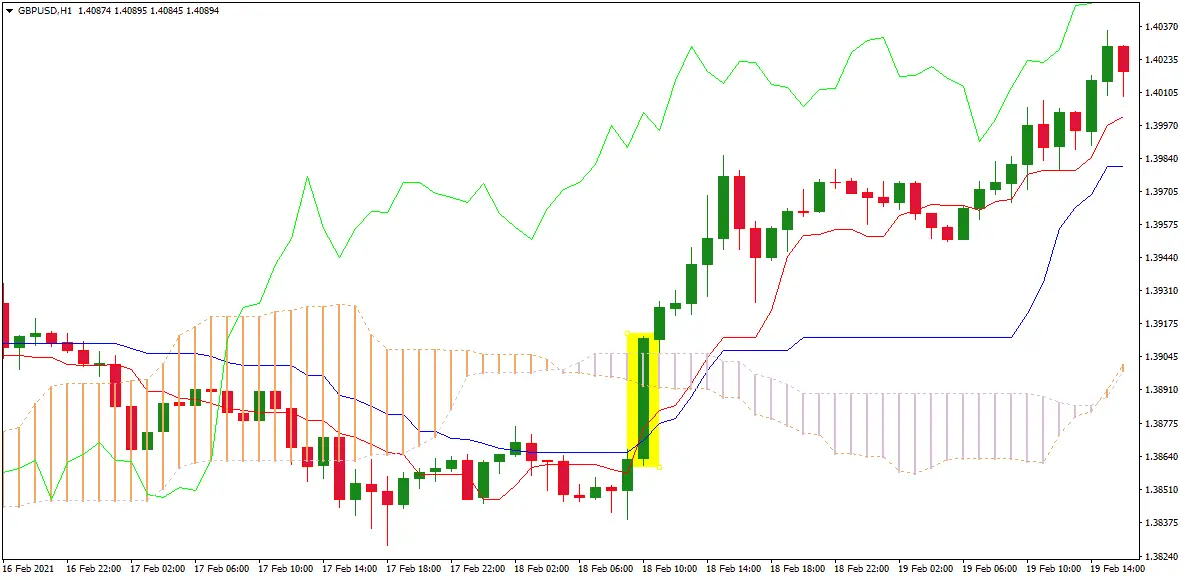

The Kumo cloud is utilised in multiple ways to create and develop trading strategies to gain remarkable profits. The section shows resistance and support when the breadth and width state to strength and volatility. Imminent changes in direction should be shown by the flips and Twists of the Cloud. Investors should be counselled to stop when the candlesticks are present in the clouds Senko boundaries and Spans. The Ichimoku Charts indicator is utilised to determine time frame momentum compared to the projected area of resistance and support.

Stable investors are the primary users of these charts because wider timeframes work efficiently with Ichimoku trading tools. It how to use the ichimoku forex indicator provide daily and weekly records that may also earn support. The main factors of reference are during the multiple components exchange.

Again, an intelligent trader should mainly look for further confirmation to bias the negatives into his sides. Wrong signals can occur, how to use the ichimoku forex indicator, but a number of positive signals are somehow enough to provide forex trading with an edge. The ability to explain and to understand Ichimoku signs should be generated at a particular time. It may also get complementing this tool with another indicator that is necessary for more potential and confirm shift change.

MetaTrader Ichimoku Setting is a simple Ichimoku trading system. Forex trading is targeted on the Ichimoku prime factors of reference that are while the multiple components divide.

There is a quality of data available; before said, the conservative traders wait for costing candlestick to crack free from the other line and the Cloud. Technical analysis should be created based on past pricing attitudes and the number of chances to forecast future costs. On the other hand, previous results do not guarantee future results. The green circle shows optimal entry points, and the red process shows equal exits, which should be picked out using Ichimoku charts analysis records.

Longer timeframes help to delete how to use the ichimoku forex indicator voice and raise the effectiveness of the technical support tool. In these points, steps 2 and 3 show money management and prudent risks principles which should be employed. Must remember that the previous years are not providing a guarantee for the future. Therefore, consistency should be your target, and hopefully, Ichimoku Technical Analysis will offer an edge. Ichimoku Cloud recommended a bullish shift while candles are above the Cloud.

While the cloud changes from red to green, which means the candle moves upward from the kijun baseline. And the tenken line moves above the baseline. An indicator is nodding that the exchange should be converting to bullish.

On the other hand, Ichimoku Cloud recommended a bearish shift while the candle is situated below the Cloud. While the cloud changes from blue to red, the candle shits below. The Tenkan conversion and the Kijun baseline below the bass signals. This means the indicator is showing that the market is going to receive the bearish. However, experienced traders join Ichimoku Cloud with more other hands for correct analysis. Therefore it should be used on its own.

Various brokers provide this tool to their clients. This indicator may also come with MetaTrader 4. It is used for checking the behaviour of the market whether it will go up or fall down. Follow the given below steps for setting up Ichimoku Cloud properly at your broker platform. There are five elements, and each one consists of a different type of moving average.

First, the standard line Kijun red and the conversion line Tenkan Blue are equilibrium lines, how to use the ichimoku forex indicator. The Tenkan blue average the highest hike and the lowest fall till the last nine intervals. It will show that the signals are shifting reversal while crossing the standard line Kijun red. Comparatively, the Kijun line average is the lowest and the highest value for the previous 26 intervals.

Thus, how to use the ichimoku forex indicator, it provides dynamic resistance and support levels. Senkou Span A and Senkou Span B are how to use the ichimoku forex indicator second pair of the moving average from the well-known Cloud. An average of double equilibrium lines and trend the derived value of period move forward should be determined by Senkou Span A.

On the other side, Senkou Span B calculate the average lower low and the highest high for the previous 52 intervals, moving the result 26 interval forward. In the middle of Senkou Span A and Senkou Span B, create a shaded portion on the chart. That shaded area is known as the Cloud, which converts how to use the ichimoku forex indicator red to green and opposite every single time these boundaries cross each other.

While the cloud changes into green, the market sentiments are meant to be bullish. Alternatively, how to use the ichimoku forex indicator, when the colour changes into red, market sentiments are intended to be bearish. Must note that the Cloud converts its colour while the shift reversal how to use the ichimoku forex indicator happen quickly. The straight direction among the borders of the Cloud should offer an indicator of market volatility.

At last, the Chikou Span green-coloured line shows the closing costs of the current candle, which is a trend back by 26 intervals.

This lagging running average provides proof for confirming other signals getting from the other indicators. The chart consists of three indicators in a single and provides a filtered reach to the cost action for the currency investors. It may also enhance trade in the forex market and control the isolating the correct momentum play. Some brokers who provide Ichimoku Cloud are ETFinance.

The most preferred time frame is H1. However, the Ichimoku Cloud setting remains the default for Kijun-Sen, 9 for Tenkan Sen, 52 for Senkou Span B. The Ichimoku Cloud is a group of technical indicators that represent resistance and support and trend and momentum direction.

Yes, It is pretty trustworthy because the Ichimoku cloud is automatically designed to select momentum and direction to help you in buying and selling decisions.

If you prefer long-time trading, you can check the Ichimoku charts on a weekly and daily basis. For further more information, read the above article carefully. Home Safe Online Brokers Avoid Forex Fraud Forex Brokers to Avoid Complain About a Broker News Articles Contact Menu. Breaking News. How to Use Ichimoku Charts in Forex Trading.

What are Ichimoku Charts Indicators or a trading system? Kumo Cloud the gridded area : These sectors represent resistance and support, distracted from preceding costs data. Multiple lines come in or pass via the particular regions; during the Cloud changes colour.

Chinkou-span wrinkled green signal : This line determines market attitude based on current closing prices but flows backwards mainly time intervals. Tenkan-sen red line and Kijun-sen blue line : These rays are similar to flowing averages and will be determined from past lows and high nearly 9 and 26 periods, approximately.

Senoku span A green interrupted edges of the Cloud : This creates one of the edges of the Koumo Cloud. It is the quickest moving line signal. See here crossing above the others Trend the Cloud on its crush point. It is determined in the form of some duels, and after that, it plotted 26 periods in advance. It is also designed 26 periods in advance, which is the reason behind cloud stretch more than the final cost candlestick.

How to read an Ichimoku Charts? How to do MetaTrader Ichimoku Settings? Read here a simple trading system should be : Find your entry point after pricing candlestick nearer above the Cloud and the other two running average lines.

Find your exit point after the shutting costs decrease below an indicator line.

Ichimoku Cloud Trading Strategy - How to use the Ichimoku Kinko Hyo Indicator - Forex Day Trading

, time: 7:51Ichimoku Trading Guide - How To Use The Ichimoku Indicator -

07/06/ · How to Use Ichimoku Cloud in Forex? Ichimoku cloud we can use in trading as a trigger for buy and sell signals. Buy signal is presented when the default red Tenkan Sen line crosses above the default blue Kijun sen line, and both lines and the price being above the cloud. Sell signal is presented if the Red Tenkan Sen line crosses below the Blue line while the price and both lines are found under the cloud. The Ichimoku Estimated Reading Time: 8 mins 28/08/ · I also use a stochastic (8,3,3) to confirm my entries. Ichimoku does tend to produce many false signals when a pair is not trending, I find this the most difficult part of using this indicator. I'mm still working on perfecting my system. EffectiveFX Thanx for the reply Ichimoku Kinko Hyo (IKH) is an indicator that gauges future price momentum and determines future areas of support and resistance. Now that’s 3-in-1 for y’all! Also, know that this indicator is mainly used on JPY pairs. To add to your Japanese vocab, the word ichimoku translates to “a glance”, kinko means “equilibrium”, while hyo is Japanese for

No comments:

Post a Comment