12/07/ · The stop-losses are a critical tool used in Forex trading to limit losses if the trade doesn’t go as planned. You simply can’t be successful in the long run if you don’t limit your downside by using stop losses. How to use Hedging Strategies. The hedging strategies work Estimated Reading Time: 9 mins 13/07/ · As a retail trader, you should never, never hedge an outright position. The only time you may consider hedging is when you write an option, even then you're still losing. The reason is, as a retail trader: 1. You need to realize you are wrong and cut your losses, do not throw good money after bad 2. You do not want to tie up capital in a hedged position 3 17/07/ · Close the Trade and Take the Hit. Sitting on a big losing position is stressful and mentally exhausting. In these situations the fight-or-flight response tends to kick-in. The natural tendency is to remove yourself from the threat as soon as possible. That will mean closing out the trade at a blogger.comted Reading Time: 7 mins

Hedging Forex Funds - Cut Your Losses Now! by Guy Lotem - Issuu

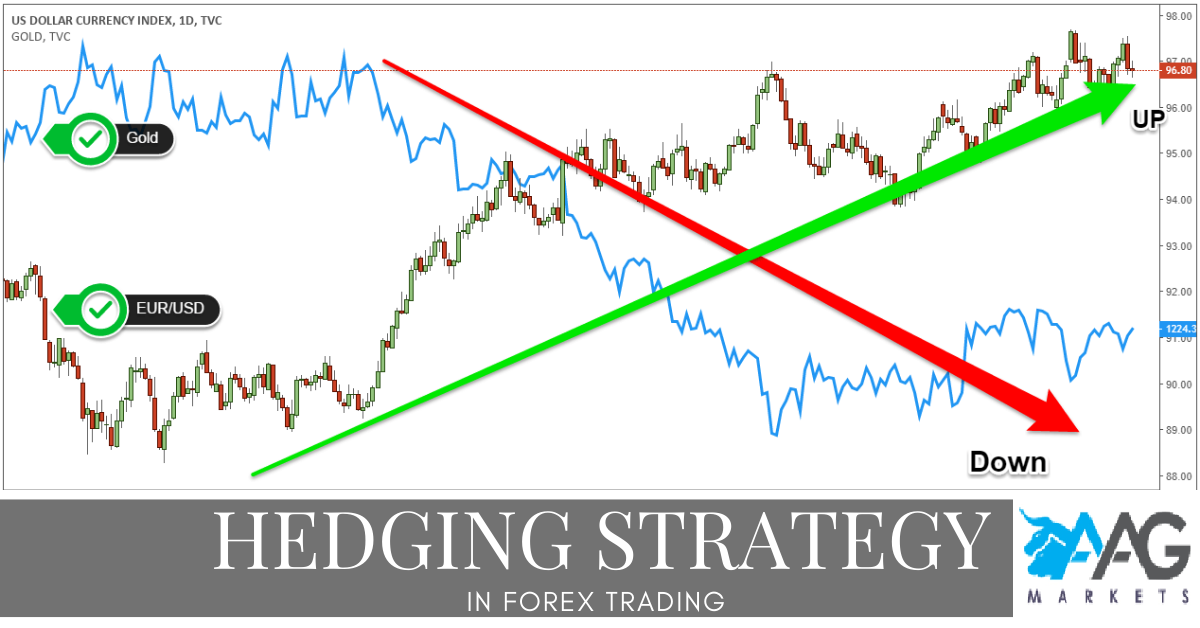

Hedging Forex Funds - Cut Your Losses Now! Cut down loss in forex hedging the last estimate, the foreign exchange market alone is believed to have a turnover of 3. Who wouldn't want to get in on that action? As always though, be safe. Hedging forex funds is just one way of cutting your losses. The foreign exchange market of today is not unlike the Gold Rush all those years ago. Ironically, money is a derivative of gold anyways, so this might very well be a sophisticated version of a similar set of events.

As before though, the small players are often kicked out by the bigger players. Sheer size can overcome the smaller accounts if not used well. There is an offer brokers provide to make your presence felt though, in terms of leverage. This is all well and good, till one realizes that their magnitude of profits is easily wiped out at times, by the magnitude of loss due to leverage.

Leverage plays a key role in wiping out smaller players. Most big players use leverage of no more than oryet still brokers encourage domestic investors to use leverages of up to !

Hence one must be wary when entering the foreign exchange market, cut down loss in forex hedging. It is unwise to be stubborn through losses as high leverage could very well cause an investor to fall in debt instead of generating profits. There are ways to overcome this though, besides the obvious using less leverage. Hedge funds are the insurance policies of the foreign exchange market. Hedge funds do come at a cost though.

This cost would usually vary cut down loss in forex hedging on the size of the investment and other factors such as the market, your broker, and the size of an investment. It is wise to invest, wiser to do so using safety nets such as hedge funds, but foolish if the cost of those funds is considerable so try to avoid this. Guy specialises in foreign currency hedging, investor reporting, cash management, budget management, FX Options and much more.

He creates customized financial models and risk analyses that help people determine where they are headed financially and what they need to watch out for. Who wouldn't want t See More, cut down loss in forex hedging.

Guy Lotem. Published on Jun 10, Go explore.

How to Hedge out of a trade gone bad

, time: 13:36How to Recover a Losing Trade and Come Out with a Profit

12/07/ · The stop-losses are a critical tool used in Forex trading to limit losses if the trade doesn’t go as planned. You simply can’t be successful in the long run if you don’t limit your downside by using stop losses. How to use Hedging Strategies. The hedging strategies work Estimated Reading Time: 9 mins Stop Loss, Hedging and Cut Loss are ways to limit losses in forex trading. Stop Loss means that we install an automatic order to close a position when the price touches a certain price level which is the limit where we are “able to hold the maximum loss”. We can determine for ourselves how many losses we are able to bear when we install this Stop Loss. Regarding the technique of determining this SL, I’ve discussed in the previous 17/07/ · Close the Trade and Take the Hit. Sitting on a big losing position is stressful and mentally exhausting. In these situations the fight-or-flight response tends to kick-in. The natural tendency is to remove yourself from the threat as soon as possible. That will mean closing out the trade at a blogger.comted Reading Time: 7 mins

No comments:

Post a Comment