23/02/ · Best Forex Trading Platforms Since , MetaQuotes and the MT4 trading platform reigned in the Forex trading platforms sector, but over the past five years, other providers managed to increase their market share. See below the top trading platforms picked by our analysts 25/01/ · There are two primary choices of the trading platform currently offered by MetaQuotes Corp - MetaTrader 4 and MetaTrader 5. MetaTrader 4 MetaTrader 4 is a platform, which was specifically designed for FX trading. As retail Forex is a relatively new industry, it did not have reliable third party software available until MetaTrader 4 appeared 13/04/ · MetaTrader 4 (MT4) is the most popular retail platform for currency trading. MetaQuotes created the trading platform in and has over 85% penetration from worldwide forex brokers. 55% of retail forex traders used the platform in based on Finance Magnates Intelligence. Based on awards, it’s considered the best forex platform

Best Forex Trading Platforms for - Which one is the best?

SinceMetaQuotes and the MT4 trading platform reigned in the Forex trading platforms sector, but over the past five years, other providers managed to increase their market share. See below the top trading platforms picked by our analysts. Get Started Read more on FP Markets 1 The ratings shown on DailyForex.

ECN-style trading Daily market research and Autochartist access Get Started Read more on FP Markets Get Started Read more on FXTM 2 The ratings shown on DailyForex. Quick and easy account registration Excellent bonuses available in some locations Get Started Read more on XM. FP Markets 5.

Australian regulators are much more relaxed about leverage than their counterparts in the U. and so fpmarkets which platform to trade forex offer a maximum leverage as high as to 1. For most traders, the standout unique selling point of this broker lies in the incredibly wide range of tradable assets offered, providing an opportunity to trade over which platform to trade forex thousand individual stocks and shares.

These go beyond the typical U. and U. companies and include a good selection of publicly traded shares on the Hong Kong and Sydney exchanges, as you might expect from an Australasian-facing broker like fpmarkets. Also, over 60 Forex pairs and crosses, 11 equity indices, the major commodities, and 5 cryptocurrencies including Bitcoin are also on the menu here.

Unique Features Headquarters. Traders can scalp and hedge at this broker, whose fast ECN execution speed makes it a natural home for scalpers. Clients may choose between the MetaTrader 4 and MetaTrader 5 platforms, and shares can be traded through the IRESS trading platform which includes access to level 2 exchange data. We have made FXTM our which platform to trade forex broker because in addition to its lengthy track record, it enjoys a very high level of regulation and reputation, which platform to trade forex, and it offers a highly competitive fee structure which tends to keep down the cost of trading.

Recent years have seen them continue to steadily expand their business, and they are well- regulated by the U. The brand is owned by private companies incorporated in the U. Customers of FXTM have access to more than 57 Forex currency pairs and crosses, which platform to trade forex, precious metals, the major energies, equity indices, big cryptocurrencies, and a few individual American stocks.

Talking of stocks, FXTM are quite unique in the area of trading stocks, which platform to trade forex, as they enable direct trading through real legal ownership, not just wrapped as CFDs like almost every other similar brokerage offers. Clients have a straight choice between two trading platforms, with both MetaTrader 4 and MetaTrader 5 on offer. Through their Mauritius regulator, FXTM offer leverage as high as to 1.

In the U. and Cyprus, they are limited by law from offering more than 30 to 1. Excellent client deposit protection. No cryptocurrencies or exotic currencies. Low minimum deposit. Low leverage for retail traders. Free MT4 add-ons and VPS hosting. Internal withdrawal fees and an inactivity fee. Good educational tools. Founded inXM has grown into a firm employing more than professionals to service the financial trading community.

It is a well-regulated firm with licenses from the Cyprus Securities and Exchange Commission CySec and the Australian Securities and Investments Commission ASIC. XM partners with investment grade banks and uses segregated accounts to ensure security.

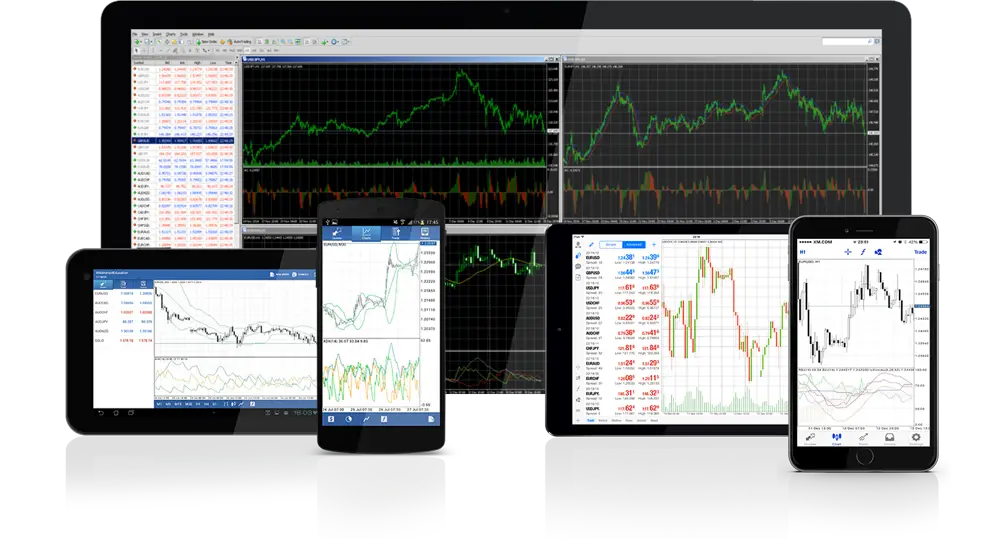

No requotes means you will always receive the price you see on the screen when you execute your trade. XM sticks to the well-known and tested MetaTrader suite, offering MetaTrader 4 and MetaTrader 5, which are both available on desktop, smartphone, and tablets. Clients can contact XM by email and a support desk by phone through multiple languages. Low minimum deposit, high leverage, and competitive trading cost. Excellent research and education. Outstanding trading tools and loyalty program.

Trustworthy and transparent with generous bonuses and incentives. Many new retail traders approach trading Forex with the same mentality as being active on social media, which platform to trade forex.

A mobile trading platform appeals to them. Traders from frontier markets and, to a marginally lesser degree, emerging markets, where income levels often prevent the luxury of owning multiple devices, generally opt for high-performance mobile devices. The problem with mobile trading platforms is not computing power but screen size. Analyzing financial markets requires more than what mobile devices can provide.

It also increases the risk of placing the wrong order or parameters for one. While a mobile trading platform is unsuitable for trading, it can provide enough for social traders who prefer to follow others with the click of a few buttons.

Plus — This broker's platform was designed with mobile traders in mind and is among the easiest to use Read More ». AvaTrade — The AvaTradeGo platform is ideal for trading options on the go Read More ». FXTM — Reliable use of MT4 and MT5 on mobile platforms makes this broker a great option Read More ». With the competition among Forex brokers heating up to capture a share of the growing global Forex market, many pay less attention to the Forex software sub-sector, particularly in Forex trading platforms.

MT4 maintains the number one spot in automated trading solutions, and the MT4 infrastructure fully supports third-party developers. The combination of both ensures that even fifteen years after its launch, no other Forex trading platform surpassed MT4. It does not which platform to trade forex that there are no competitors, but MT4 is the only one offered by almost every online Forex broker. Demand from emerging markets warrants additional investment in the Forex trading platform sector, with FinTech companies joining the competition and disrupting the industry.

Frontier markets provide an additional opportunity, which platform to trade forex internet access becomes more widely which platform to trade forex, with a distinct focus on trading from mobile phones rather than laptops and computers. The next decade appears ripe for more innovation, and we have taken a look at MT4 and its successor MT5plus eleven established competitors.

Cyprus-based MetaQuotes established the global market leader in retail trading platform with the launch of MT4 in One of the pioneers of FinTech, the company understood the significance of automated trading solutions and made it one of its core features. Support for third-party developers assisted MT4 in its meteoric rise, making the MT4 infrastructure more valuable than the MT4 trading platform.

It allowed professional traders, proprietary trading outlets, and hedge funds to create cutting-edge trading solutions, with the most advanced ones simply connecting to MT4 for order placement. Today, over 15, custom indicators and expert advisors EAs exist, and development teams at FinTech companies, as which platform to trade forex as individual traders, continue to add new ones, which platform to trade forex the unsuccessful MT5 successor platform.

MT5 failed amid a lack of backward compatibility to MT4, which almost every broker supports, which platform to trade forex, with hundreds of millions of traders using it. Fifteen years after its launch, MT4 remains the most used trading platform globally.

It represented the first specific online trading platform and was able to capture the market with ease. Its ongoing success created an entire ecosystem, and it continues to grow. MT4 supported the explosive growth of online brokers with a low-cost trading platform and continues to do so.

While the out-of-the-box version represents a sub-standard Forex trading platform, though sufficient for most trading needs, an upgraded MT4 can compete with the most advanced alternatives. The most significant advantage of MT4 is its flexibility, which platform to trade forex. Developers can take the core trading platform and create add-ons, custom indicators, EAs, and complete trading solutions on the MT4 infrastructure.

Since nearly all well-established Forex brokers offer MT4, traders have more choices than with any alternative, as there are more than 1, known MT4 brokers operational today. With more than fifteen years of experience, it is also the most reliable, used, and trusted trading platform.

Among the best Forex trading platforms for beginners, it maintains an undisputed edge due to countless tutorials and videos.

MT4 is available as a desktop client, a webtrader with a significantly improved user interface, and a mobile application. Necessary paid upgrades to the core MT4 trading platform remains the most obvious disadvantage. The desktop user interface looks dated and is one of the most cited nuances of working with MT4. Developers must learn the MetaQuotes Language 4 MQL4 to create custom solutions, as it does not support other coding languages.

Advanced FinTech companies may only code an MT4 bridge, often provided by brokers, and develop in their preferred language. The MetaTrader 4 Supreme Edition Add-On is a third-party add-on that notably upgrades the MT4 trading experience.

Developed by Admiral Markets, MTrading also deploys it. It consists of nine significant which platform to trade forex to MT4 which platform to trade forex Admiral Markets, offering clients a competitive edge. MTrading lists only six, with no explanation for the difference. FXTM — Solid execution of both mobile and desktop versions of MT4 Read More ». AvaTrade — Fast trading on MT4 makes AvaTrade a good choice for all traders Read More ». Launched inMT5 failed to replicate the success of MT4.

The lack of backward compatibly remains the most significant reason for this. MT5 was intended as a multi-asset trading platform, offering CFD trading while being compliant with US regulations, but most brokers decided to offer CFD trading in MT4. It is also a more expensive alternative and lacks the support MT4 enjoys. MT4 is available at most brokers, but MT5 struggles to break into the market, becoming a victim of the success of its predecessor. MT5 does feature an improved user-interface, expanded technical indicators and graphical objects, a streamlined news service, and support for more assets, which platform to trade forex.

Professional traders will benefit from the added market depth functionality, and MetaQuotes markets it to hedge funds. Despite the effort and visible improvements, a decade after its launch, it has not shown promising progress. Similar to the MetaTrader 4 Supreme Edition Add-On, it provides a much-needed upgrade to the core MT5 trading platform.

Admiral Markets is the only known broker offering it to traders and is the apparent developer of it or the one with exclusive rights. FXTM — Overall best broker for MT5 Read More ». Blackbull Markets — ECN execution on the MT5 platform Read More ». XM — Widest range of assets available on the MT5 platform Read More ».

Forex Trading for Beginners

, time: 8:3925 Best Forex Trading Software and Platforms (☑️ Updated )

Forex trading platforms: The CMC Markets Next Generation platform comes with a massive selection of nearly 10, tradeable instruments. It delivers a terrific user experience, advanced tools, comprehensive market research, and an excellent mobile app. Best Forex Trading Platforms. Saxo Bank - 25/01/ · There are two primary choices of the trading platform currently offered by MetaQuotes Corp - MetaTrader 4 and MetaTrader 5. MetaTrader 4 MetaTrader 4 is a platform, which was specifically designed for FX trading. As retail Forex is a relatively new industry, it did not have reliable third party software available until MetaTrader 4 appeared 13/04/ · MetaTrader 4 (MT4) is the most popular retail platform for currency trading. MetaQuotes created the trading platform in and has over 85% penetration from worldwide forex brokers. 55% of retail forex traders used the platform in based on Finance Magnates Intelligence. Based on awards, it’s considered the best forex platform

No comments:

Post a Comment