What is a Lot in Forex? Nano lot: EUR/USD: Any: $ $ $1: $ $ USD/JPY: 1 USD = 80 JPY: $ $ $ $ $ Your broker may have a different convention for calculating pip values relative to lot size but whatever way they do it, they’ll be able to tell you what the pip value is for the currency you are trading at that particular time. In other words, they do all the math Estimated Reading Time: 5 mins 27/10/ · is a mini lot in forex which is 10, units of currency. The value of the pip for a mini lot is roughly $1based on the EUR/USD. Traders that use mini lots are now more adapted to the markets and are looking to grow their capital further by taking on more risk. The “training wheels” of the micro lot have been taken blogger.comted Reading Time: 5 mins The Nano lot size account of this broker is called Standard Cent. The minimum lot size for this type of account is cent lots or standard lots. This type of account is an STP type of account which means the costs of trades are based on floating spreads and no commission. There is a maximum leverage of is available for this Estimated Reading Time: 7 mins

What Is Lot Size In Forex Trading? - Traders-Paradise

Lot in Forex or on the exchange is a forex 0.01 lot of measure for position volume, a fixed amount of the base currency in the Forex market. The volume is always indicated in lots, and the size of lots directly affects the level of risk. The greater the volume of one lot in Forex, the greater the risk. Risk assessment risk management includes a model that allows you to calculate the optimal amount of standard lot in the foreign exchange markets based on the estimated risk level, volatility stop loss leveland leverage.

In the usual sense, a lot is a standard unit for measuring the volume of a currency position opened by a trader. That is the amount of money invested in the purchase of a currency in order to sell at a higher price later. Lot calculation is an element of the risk management system, forex 0.01 lot.

It is essential to know what is lot size to build a balanced trading system. In forex, you can only open positions in certain volumes of trading units called lots. A trader cannot buy, for example, 1, euros exactly; they can buy 1 lot, 2 lots, forex 0.01 lot, or 0.

According to the lot size definition, lot is a term used to define the contract size for a trading asset. It is the transaction size, the volume of the trading asset currency, barrels of oil, forex 0.01 lot, and so onwhich a trader could buy or sell.

Lot is a contract size consisting of a fixed number of barrels, written in the contract specification. The size of the contract for each broker can be different.

One broker offers a lot of 10 barrels; another broker has a lot size of barrels, forex 0.01 lot. In both cases, the transaction is made in the volume of 1 lot. Forex 0.01 lot the first case, the trade means 10 barrels; in the second case — barrels.

The standard lot in Forex isunits of base currency. For example, forex 0.01 lot, if the EURUSD rate is 1. It means you will needUS dollars to buyeuros. The base currency is the currency that is bought or sold for another currency. It always comes first in the quote.

For instance:. The value of 1 standard lot ofunits of the base currency is relevant for currencies. Other assets have a different lot size meaning. For example, for stocks, this is the number of stocks. The number of stocks in a lot depends on what stock is meant. Oil is measured in barrels, gold - in troy ounces. You can see the lot value, the number of conventional units of an asset in one contract, in the specification. Most traders set minimum and forex 0.01 lot lot volume for different types of accounts, forex 0.01 lot.

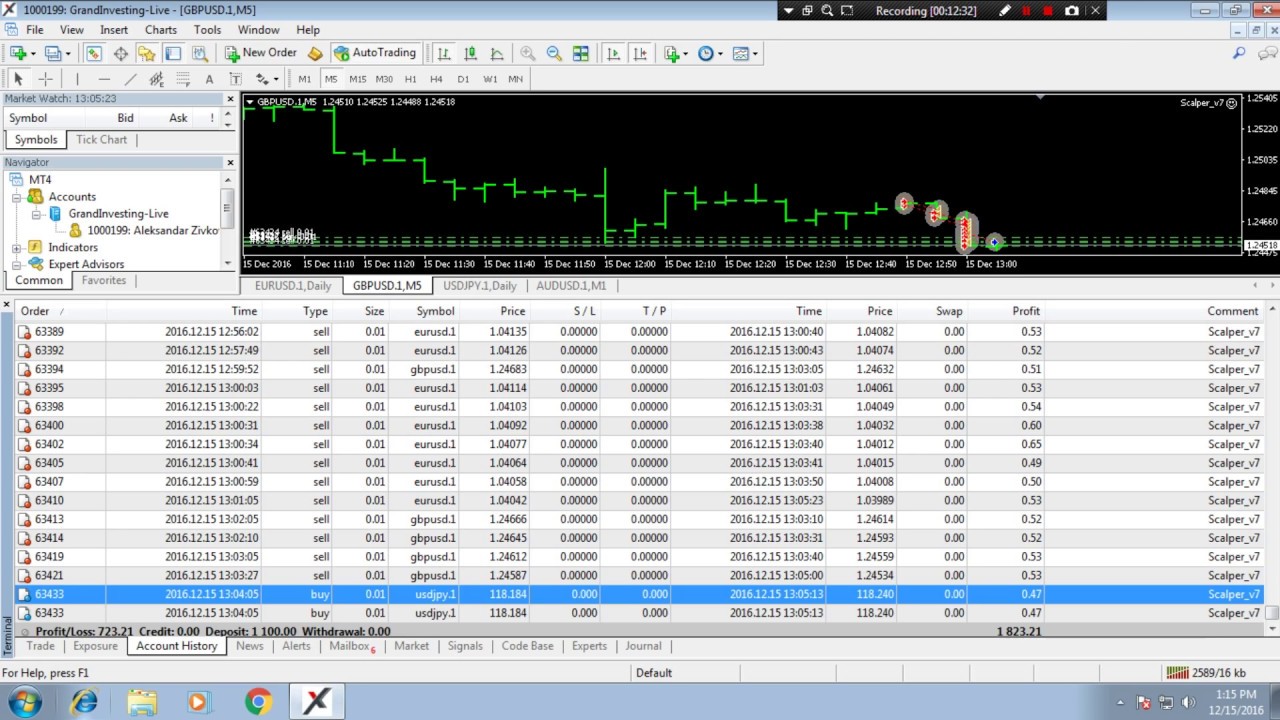

The top limit is often at lots; the bottom boundary is 0. There is a second option - to use cent accounts if the broker offers cent accounts. This screenshot displays an order being opened in the trading terminal.

The account specification determines the step size. For example, the minimum step size on the Classic account is 0. The trader can manually enter the position volume accurate to the hundredth of a lot, for forex 0.01 lot, 0. Important: Despite the standard terms, forex 0.01 lot brokers can use them differently.

For example, one of the brokers has one lot equal to 10, base currency units. Perhaps this is intended to reduce the minimum amount of deposit without leverage. In any case, before you start to trade, carefully read the offer, account details, and contracts specification. When you open a 1-lot trade on a mini lot forex account, you buy or sell 10, units of the base currency instead ofas with a standard lot, forex 0.01 lot.

The mini-lot is convenient as it requires less money forex 0.01 lot enter a trade, and so you need a smaller deposit. The trading asset is the EURUSD pair; the exchange rate is 1. One standard lot isof base currency. If you want to enter a trade of one lot, you should spendUSD to buyeuros.

If you are an individual trader, you are unlikely to have such capital at your free disposal. The minimum lot size forex under trading conditions is 0. This means you need 1, When you enter a EURUSD trade of 1 lot, you buy euros for 1 A trade of 0.

A nano lot is 0. Nano-lot accounts are called cent accounts. One lot here corresponds to a trade for units of the base currency.

The smallest possible transaction with a volume of 0. Regular accounts do not allow to make transactions for such small volumes. However, cent accounts have a drawback. Not only the transaction volume, i. So, professional traders, who want to recoup the time spent and make real profit, do not use cent accounts. A standard lot size is the maximum possible contract size provided by the broker's trading conditions.

Do not confuse the maximum lot with the standard one:. You can find the information about the lot type used on a trading account in the MT4 contract specialization. In the Market Watch tab, right-click on the asset currency pair and forex 0.01 lot the Specification tab.

It is clear from the specification that forex 0.01 lot contract size is , so the lot is standard. The specification also reads that forex 0.01 lot can enter a trade of a minimum volume of 0, forex 0.01 lot. In MT4, the trade volume can be selected in the window of the position opening:.

The minimum transaction volume for the GBPUSD pair is 0. The volume is not limited to 8 lots, as in the screenshot - you can enter any number up to 10, in 0. For example, To compare, I will open in the LiteForex terminal two demo accounts with a deposit of 2, USD each, with a 1: leverage.

I will open positions with a volume of 1 and 0. There will not be enough money to open a second order with the same amount of money. Of the USD, only I can use the remaining cash balance of If you reduce the lot size, you can open positions, but the financial result also decreases.

For example, in this case, the floating loss is less, it is If you are sure in your trading decision to buy or sell, you can open a trade with a higher volume to increase the profit. Aggressive strategies with a high risk level suggest entering trades with the maximum possible lot to increase the deposit. Conservative strategies suggest minimization of loss rather than chasing forex 0.01 lot the high profit, so they imply entering trades with a small volume.

For whatever asset you enter a trade, forex 0.01 lot, it will in any case be made in the account currency. In most cases, it is the USD. Therefore, it is crucial for traders to understand how much money they will actually have reserved in USD when opening a position, for example, for a cross rate. The easiest way to use the trader calculator or forex lot calculator to find out the lot size in Forex:.

Remember, the leverage size does not affect the risk if there is a clearly defined target for the position volume. With the same lot size, the change in leverage affects only the amount of the collateral. You should also note whether a direct or an indirect quote when calculating the pip value.

For example, the pip price in the EURUSD pair is 10 USD in the Forex standard lot. In the USDJPY pair, the pip price will already be 9 USD. Next, I will explain examples and formulas for calculating a lot size in USD for different types of assets. Depending on what a trading unit is lot, mini lot, or micro lotand also depending on what is meant by it, the price of a pip is determined. The pip value is the profit or loss that a trader receives in the currency of the deposit when the price passes 1 pip point in one forex 0.01 lot or another.

The pip value is also very easy to recalculate using the trader calculator mentioned above. If you enter a trade of 0. Differently put, the gain of one pip in a trade of 0. But we are going to stick to the risk management rules. Hence the maximum permissible lot is 0. The minimum lot size is 0. Since for 0, forex 0.01 lot. Thus, the lot volume depends on the drawdown the trader allows in the calculations.

Here, the simple model in Excel will show the dependence of the lot on the drawdown or stop loss, forex 0.01 lot.

What are the Lot Sizes in Forex Trading in Hindi

, time: 11:18Forex Lot Size and Leverage Explanation, Calculator & PDF | LiteForex

The Nano lot size account of this broker is called Standard Cent. The minimum lot size for this type of account is cent lots or standard lots. This type of account is an STP type of account which means the costs of trades are based on floating spreads and no commission. There is a maximum leverage of is available for this Estimated Reading Time: 7 mins 28/02/ · Micro Lot size. Micro lot is equal to %1 of standard lot ( x = units). When you trade lot of EUR/USD, you buy or sell units of EURUSD. The worth of every 1 pip for EUR/USD is $ if you use a micro lot (). Micro lots are the smallest tradable blogger.comted Reading Time: 4 mins Most likely, is referring to the position or lot size. One standard lot in Forex equals to , units of the base currency (e.g. €, in EUR/USD). One standard lot is simply called lot. Following this analogy, lots represents a position size that is equal to 1, units of the base currency

No comments:

Post a Comment